st louis county sales tax rate 2019

The St Louis Park sales tax rate is 0. Statewide salesuse tax rates for the period beginning January 2019.

Minnesota Sales And Use Tax Audit Guide

View the latest information about COVID-19 from the City of St.

. You pay tax on the sale price of the unit less any trade-in or rebate. School districts res comm agri pp 101 affton. Tax rates for 2019 school districts all political subdivisions tax rate 2019 2019 page 1 of 1147.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. At issue was an arrangement detailing how St. The Minnesota sales tax rate is currently 688.

Statewide salesuse tax rates for the period beginning October 2019. The minimum combined 2022 sales tax rate for St Louis Park Minnesota is 753. Code Local Rate State Rate Combined Sales Tax 1 A Eff.

Location SalesUse Tax CountyCity Loc. There is no applicable county tax or special tax. Local Sales and Use Tax Rates by CityCounty Tax Rates Effective January 1 - March 31 2019.

The 9679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax and 5454 Saint Louis tax. 2019 City of St Louis Property Tax Rate 69344 KB 2019 City of St Louis Merchants and Manufacturers Tax Rate 63897 KB 2019 Special Business District Tax Rates for City of St Louis 66673 KB Historical Property Tax Rates for City of St Louis 66536 KB. Louis Department of Health.

In 2019 the tax rate was set at 816 and distributed as follows. Florida County Surtax Changes for 2019. How Mortgage Forbearance Works Under CARES ACT Video Showings of St Louis Listings Increase Forty-Two Percent Since Low 8 Days Ago.

Location SalesUse Tax CountyCity Loc. The minimum combined 2022 sales tax rate for St Louis County Missouri is. Did South Dakota v.

This is the total of state and county sales tax rates. Subtract these values if any from the sale. Local Sales and Use Tax Rates by CityCounty Tax Rates Effective April 1 -.

The Missouri Supreme Court on Tuesday rejected Chesterfields bid to keep more of the sales tax it generates. Coco chanel handbags for. The County sales tax rate is 015.

Louis County cities handle a 1 sales tax. Skip to main content. Although the official application deadline has passed we are still accepting applications for the April 28 June 23 2021 session of the Intensive English Program.

St Louis Homeownership Rate For 2019 Highest In Four Years. Louis community college 01986 01986 01986 01986. Home Sales In St Louis 5-County Core Market Have Trended Upward Last 3 Years Time To Sale Rises Sharply.

A county-wide sales tax rate of 2263 is. State and local sales tax rates as of January 1 2019. Below is a summary of the surtax rate increase for each county along with the total surtax rate effective Jan.

Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund. Statewide salesuse tax rates for the period beginning April 2019. ALL FUNDS REVENUES IN MILLIONS 2017 Actual 2018 Budget Estimate 2018 Revised Estimate Change Change 2019 Projected Change Change Tax Revenue Property Tax 1089 1143 1197 109 100 1132 65 54 Sales Tax 3426 3795 3910 483 141 3973 63 16 Sales.

There are nine counties in Florida that have increased their county surtax rates. This is the total of state county and city sales tax rates. Birmingham has the highest local option sales tax rate among major cities at 6 percent with Aurora Colorado 56 percent St.

Sales tax revenues are projected to increase by 63 million or 16 in 2019. 102019 - 122019 - XLS. The Missouri state sales tax rate is currently.

Louis county 04430 04670 03980 05230 st. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. 1325 G St NW Suite 950 Washington DC 20005.

The change was largely due to a 1 percent sales tax in Broward County and a 15 percentage-point local increase in Hillsborough County. The St Louis County sales tax rate is. In various Florida counties tax increases were agreed upon and set to begin in 2019.

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax corporation income tax and corporation franchise tax. Why Im Bullish On Real Estate For 2020. 012019 - 032019 - PDF.

Louis Department of Health View the latest information about COVID-19 from the City of St. ALL FUNDS REVENUES IN MILLIONS 2017 Actual 2018 Budget Estimate 2018 Revised Estimate Change Change 2019 Projected Change Change Tax Revenue Property Tax 1089 1143 1197 109 100 1132 65 54 Sales Tax 3426 3795 3910 483 141 3973 63 16. The 2018 United States Supreme Court decision in South Dakota v.

Has impacted many state nexus laws and sales tax collection requirements. Car lift rental st louis mo. Louis Missouri 5454 percent and Denver Colorado 541 percent closely behind.

082019 - 092019 - XLS. Check out our new state tax map to see how high 2019 sales tax rates are in your state. 44 rows The St Louis County Sales Tax is 2263.

Saint louis cardinals ranking. Code Local Rate State Rate Combined Sales Tax 1 A. Clark County Sales Tax Rate 2019.

Sales tax revenues are projected to increase by 63 million or 16 in 2019.

Tim Fitch Chieftimfitch Twitter

St Louis County 2019 By Stltoday Com Issuu

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Collector Of Revenue St Louis County Website

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Missouri Car Sales Tax Calculator

States With Highest And Lowest Sales Tax Rates

Cigarette Taxes In The United States Wikipedia

Chesterfield Missouri S Sales Tax Rate Is 8 738

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

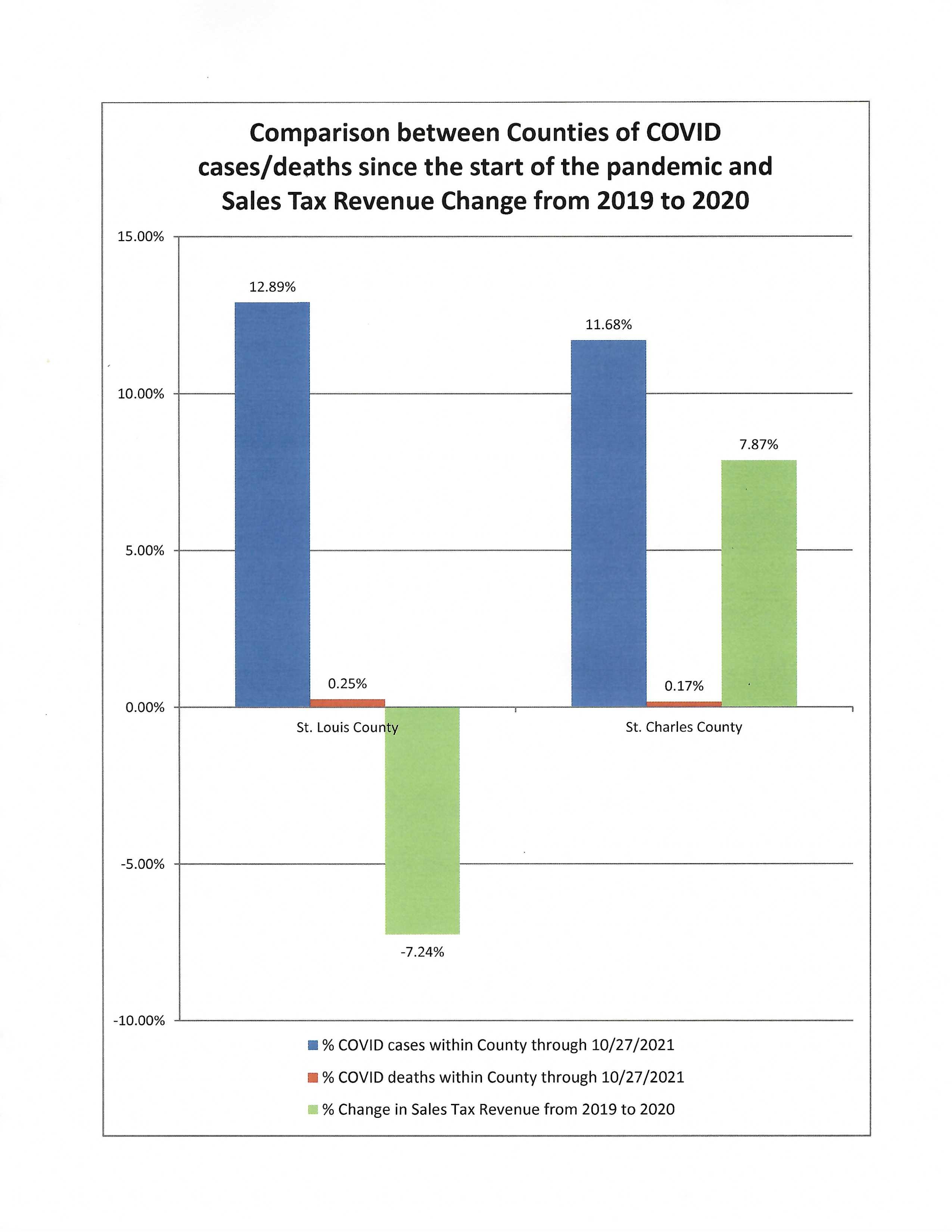

Fourth Quarter 2020 Taxable Sales Nextstl

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More